Last month we enjoyed some of the most important annual events in the art world: the Frieze London and Art Basel, held this year at the historic Grand Palais in Paris. Contemporary art filled both European capitals, transforming the autumn routine for a few weeks into a world of intense colours, surprising installations and reflections on the contemporary world. We were able to admire iconic galleries such as David Zwirner, Gagosian or Pace Gallery, emerging and established artists, but what was essential were the conversations that took place between the most important representatives of today’s art world. A recurring theme in the discussions was the future of collecting, and in particular the new generation of collectors who will soon dominate the art market.

Representatives of the younger generation are bringing a sense of dread in the traditional art market and heralding changes that could turn the art world upside down. Unlike previous generations, who saw art as a status symbol or investment, the upcoming collectors bring new perspectives on transparency, accessibility and support for the artists themselves. As the market adapts to these values, questions arise about what the art market will look like in a decade or two, and how institutions, collectors and artists can prepare for this change.

The demand for transparency

Transparency in the world has always been an important part of the culture of younger generations. Growing up in a social media environment, it is easy to share information quickly and form opinions about the inequalities that are visible around us. The art world, like many others, is becoming an increasingly important issue and source of controversy among new generations, and transparency has become a defining value for younger art collectors, who often find traditional market structures opaque and unreachable3.

A major event that confirmed concerns about the lack of transparency in the art market was the legal battle between the Swiss art dealer Yves Bouvier and the Russian oligarch Dmitry Rybolovlev4. The case concerned the concealment of the true value of works of art, which are often sold to collectors at inflated prices without giving them the opportunity to find out the previous prices at which such works were originally purchased. After nearly a decade of litigation over allegations of overpricing and manipulated transactions, the case ended last December with Rybolovlev claiming that although he had not won, he had helped to draw attention to the lack of transparency in the art market5.

For many young collectors, the case highlighted what they saw as persistent problems in the market and reinforced their belief that reform was needed. The case has set the stage for a conversation about a fairer, more open marketplace that addresses these concerns and includes tools and platforms that facilitate safe and transparent transactions.

Digital innovations and technological disruptions

Another aspect affecting the future of art collecting is the new technologies entering the art market. Younger generations, raised on digital platforms, are naturally drawn to the innovations that are currently reshaping the world. Blockchain technology, online auctions and AI have each played a role in making the market more accessible and democratised. For example, online-only auctions accounted for nearly 60% of total volume in the first quarter of 20246, marking a significant shift from traditional face-to-face sales. This development not only represents a new norm, but also appeals to younger buyers who prioritise ease of access and digital engagement.

Online auctions are also reshaping generational priorities in art collecting. According to many art magazines, a significant proportion of new collectors now tend to buy pieces directly from artists through digital channels, placing traditional auction houses and galleries lower on their list7. This trend reflects a profound cultural shift in which young collectors value not only the artwork, but also the support and empowerment of the artists themselves. It’s a move towards a more personal and ethical approach to collecting, underlining a desire to connect more authentically with the creative minds behind each piece.

The growing popularity of platforms such as Artory and Verisart, which use blockchain to certify art, is another sign that digital innovation is transforming the art market. These platforms promise secure, verifiable records of art transactions, offering young collectors peace of mind that they are acquiring legitimate, certified works. The decentralised nature of blockchain could effectively address concerns about transparency and authenticity that have long plagued the market. In the future, the sophisticated security offered by blockchain technology could help prevent the circulation of fake artworks, addressing a problem that has affected collectors and experts for centuries.

However, as digital channels and blockchain technology revolutionise the art market, they also bring their own challenges. While blockchain offers a promising solution for transparency and authenticity, it also raises concerns due to high energy consumption and an evolving regulatory landscape that could hinder widespread adoption. In addition, the rise of online auctions and digital transactions risks alienating collectors from physical art spaces, potentially weakening the immersive and communal experience of art. To preserve these essential aspects, art institutions may need to explore innovative ways to merge online and in-person experiences to ensure that the art world remains both accessible and vibrant in a digital age.

New approach to collecting: passion over investment

In contrast to the investor-driven model that has long defined the art world, many young collectors are motivated more by passion and a desire to support the creative community. A survey by MyArtBroker found that 96.3% of Gen Z buyers buy art primarily for personal enjoyment, while 87% are driven by a desire to support artists they admire8. This shift suggests that collecting is becoming a more intimate activity, where acquiring art is a way to connect with artists and engage with their vision, rather than for financial gain.

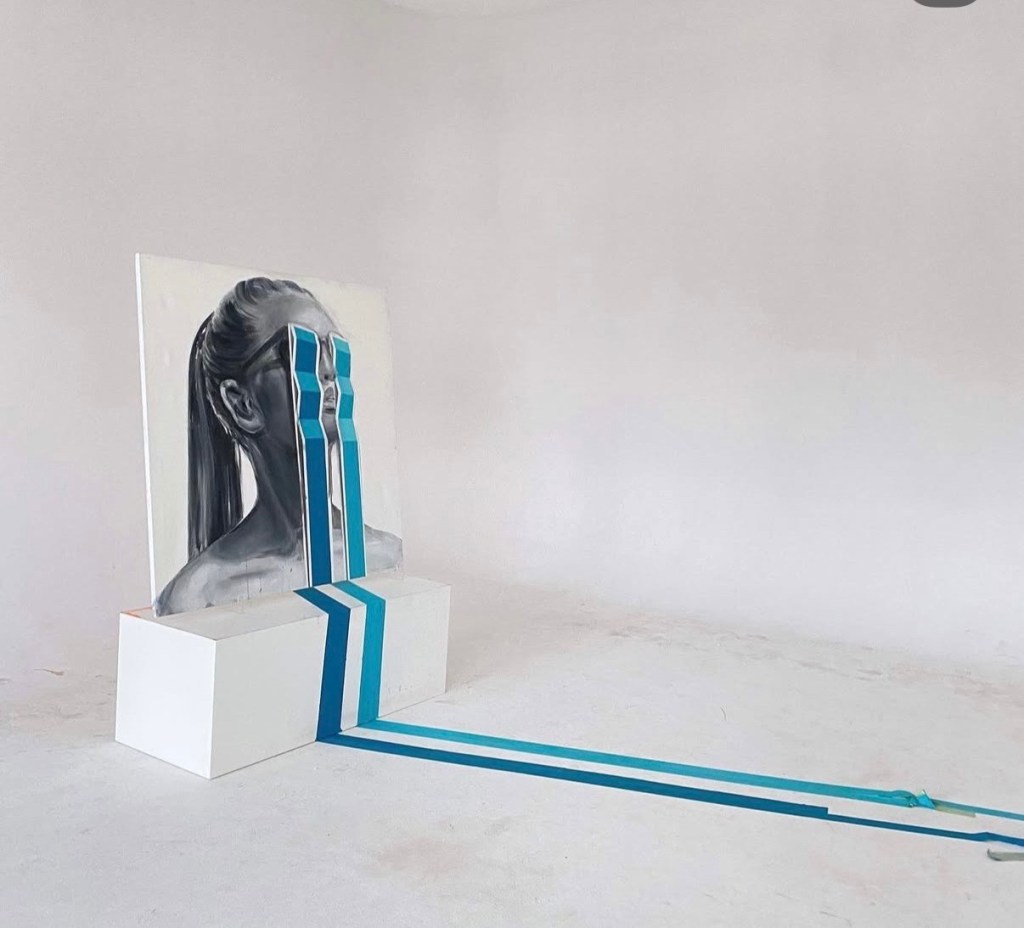

The Gen Z approach to collecting is also influenced by the types of art and themes they choose to support9. Many young collectors are drawn to works that explore world issues, such as climate change, social justice, and mental health. They often choose prints by both emerging and established artists that address these pressing issues. Genres such as street art and photography are particularly popular10, with many collectors appreciating the raw, authentic narratives these mediums offer. New generation seeks art that is not only visually arresting, but also embodies the stories and struggles of their time, allowing them to make a personal connection with the pieces they choose.

This emphasis on supporting artists and collecting for personal enjoyment does, however, present a challenge for the future financial stability of the art market. Since many young collectors lack the resources or knowledge to invest in high-value pieces, there is a risk that the art market may experience slower growth as these generations become the primary collectors. Yet, as these individuals accumulate wealth, their attitudes towards art as an investment may evolve, potentially merging their passion-driven approach with the financial motivations seen in previous generations.

Ultimately, it is difficult for us to say exactly what the future of art collecting will look like in a few years time. New generations are still in the process of accumulating their wealth, and in a few decades their attitudes may change significantly. What is certain is that the traditional art market will have to prepare for new innovations that are already visibly changing the reality of art collecting and introducing new techniques for creating works, such as digital art. The popularity of new technologies among young people and their impact on the subsequent transparency of the market is significant, and it is at this point that galleries, auction houses and all art institutions should prepare for the inevitable change.

Sources :

- https://www.theartnewspaper.com/2024/08/16/digital-platforms-expand-print-market-gen-z-collectors. – “The new generation [of collectors], which forms the majority of our community, care deeply about transparency, about being able to make well-informed decisions through data and insights, and also about accessibility,” says Mazdak Sanii, founder and chief executive of Avant Arte.

- https://news.artnet.com/art-world/yves-bouvier-rybolovlev-dispute-settled-2406832

- https://www.cnbc.com/2024/01/30/russian-oligarch-rybolovlev-loses-suit-accusing-sothebys-of-art-fraud.html – Rybolovlev’s lawyer Daniel Kornstein said, “This case achieved our goal of shining a light on the lack of transparency that plagues the art market. That secrecy made it difficult to prove a complex aiding and abetting fraud case.”

- https://arttactic.com/editorial/q1-2024-5-key-takeaways-from-the-global-auction-landscape/ – “Online-only auctions claimed a larger share of the market, constituting 59.8% of total volume and 13.2% of total sales value for the three auction houses in Q1 2024.”

- https://artstoheartsproject.com/do-art-collectors-prefer-buying-artwork-from-artists-or-art-galleries/

- https://www.myartbroker.com/investing/articles/gen-z-art-collectors-future-how-will-they-buy

- https://artlyst.com/features/the-art-of-choice-for-baby-boomers-generation-x-millennials-and-gen-z/

- https://www.myartbroker.com/investing/articles/gen-z-art-collectors-future-how-will-they-buy

Leave a comment